Going through a separation or divorce is often made more complicated when there are children involved. While couples may want to finalise financial and property settlement as quickly as possible post-separation, when it comes to custody of children and child support, it’s essential to consider what is best for the child in the long run.

In Australia, both parents are legally required to support their child under the Child Support Scheme, so regardless of where the child lives, each parent has a financial obligation to support the child until they turn 18.

This article will give you an overview of child support in Australia and how it may work in your family.

Key takeaways

Child support is financial support paid by one parent to the other to help with the costs of raising a child after separation or divorce.

Parents can agree on child support payments privately or through a binding agreement. They may also have Services Australia assess and calculate the amount.

The amount of child support is based on factors like each parent’s income, the number of children, the children’s ages, and the time children spend with each parent.

Child support covers expenses related to the child’s needs. These may include food, housing, medical care, education, and extracurricular activities.

Parents who disagree with Services Australia’s child support assessment can request a review or appeal the decision through legal channels.

Understanding Child Support in Australia

Under the Child Support Assessment Act, child support means ongoing financial support provided to a child after their parents have separated or divorced. It is designed to help cover the expenses of raising a child, such as food, clothing, medical costs, school fees, housing, and more.

Child support is commonly paid from one parent to the other in regular payments. But it can also be paid as a lump sum or by paying for specific costs, such as school fees.

In Australia, Services Australia is the child support agency governing most of Australia’s child support agreements, although child support can be handled in two ways. In both cases, the receiving parent must have at least 35% care of the child.

First, you and your ex-partner can privately agree to a binding child support agreement. You aren’t required to get an assessment from Services Australia, unless you’re requesting a lump sum agreement. Both parties need to receive independent legal advice. You will then be provided with a certificate showing you satisfied this requirement.

Secondly, you can apply to Services Australia, which makes an assessment and calculates the amount payable. This is called a limited child support agreement. A limited agreement doesn’t require parties to receive independent legal advice. However, it’s still recommended.

For many families, coming to an amicable agreement without involving Services Australia is usually less stressful. It can be handled between you and your ex-partner or with the help of a family lawyer. In some circumstances, however, this isn’t possible. Services Australia can then decide on the appropriate payment.

What does child support cover exactly?

There are no set rules under Australian law on what child support can and cannot be used for. All that’s required is that it must be used for the child’s benefit. Parents cannot use the money to pay for goods and services that benefit them.

It is designed to cover the fixed costs of raising a child that are regularly shared between parents, such as food, shelter, clothing, school fees, school uniforms, extra-curricular activities, and medical fees.

Can I apply for child support?

Yes, you and your ex-partner can make your own arrangements for financially supporting your children without applying for an assessment from Services Australia. This way of organising child support isn’t legally enforceable. Because of this, it generally isn’t recommended to make such informal arrangements. However, if you believe this could be appropriate for your circumstances, here’s how you can make it work.

Open communication

Be honest with each other about your child’s financial needs. Think about daily expenses as well as the cost of factors like medical care, education, and extracurricular activities. Make sure you keep your child’s well-being at the centre of your decisions. There’s no room for personal animosity.

Be upfront about any changes to financial circumstances. That goes for both parents. If the receiving parent’s child-related expenses increase, communicate that to the co-parent. If the paying parent experiences financial difficulties, such as loss of income, this must be discussed as soon as possible. Try renegotiating payments so that both parties can satisfy their responsibilities.

If you aren’t able to find agreement on certain issues, consider involving a mediator. In independent third party can assess your situation more objectively and help you find an agreeable solution.

Determine an appropriate contribution

How much child support the contributing parent pays should account for the reasonable expenses of the child and the parent’s financial capacity. The parent who takes on the majority of the parenting responsibilities will typically receive the payments. If the payments are significant enough that they negatively impact the paying parent’s ability to continue child support for the required period, the payments should be recalculated. There are online calculators available to help you understand how formal child support assessments are determined.

Create a budget

Break down all of your child-related expenses. These could relate to clothing, healthcare, schooling, etc. This helps both parents understand how the money will be spent. You may decide that each parent will be responsible for certain expenses. If the paying parent is accountable for specific expenses, it can be easier to determine the appropriate amount payable.

Set a payment schedule

Consider the timeframe for payments. The paying parent may forward money weekly, fortnightly, monthly, etc. The most sensible payment schedule depends on your situation. Expenses may accrue throughout the week, or mostly towards the end of the month. This will inform whether payments should be more or less regular.

Child support doesn’t always have to be paid periodically. You may find that a single lump sum payment is more suitable than regular instalments.

Write down the agreement

Put whatever agreement you come to in writing. This makes it easier for both parents to understand their obligations. Verbal agreements can seem like a good idea. However, they’re vulnerable to reinterpretation. When the agreement’s in writing, it’s clear what provisions are in place. Both parents should keep a copy.

Record payments

All parties should keep records of all payments that are made. It may be worth comparing records regularly to ensure you’re on the same page. Documenting payments can be especially useful if a parent is struggling to meet payment deadlines. If you agree to defer payments, a rigorous documentation will ensure you stay up-to-date on how much is owing within the timeframe.

Implement a conflict resolution plan

Since you won’t be able to rely on the Court to enforce your agreement, you’ll need to make sure you can resolve conflicts effectively in private. If you’re running into issues such as unpaid child support, how will you enforce the agreement? Professional mediation is an option. A mediator can help you structure a discussion to get the most our of your sessions.

Alternatively, you can organise regular meetings to talk through any concerns. To keep the meetings structured, consider writing down discussion points beforehand. This will help you stay on message and cover all relevant issues.

Even if you have an amicable relationship with your ex-partner, it is always advised to seek independent legal advice and put your child support agreement in writing. This ensures clarity on what is required of each person and avoids conflict if one person tries to back out of their part of the agreement.

You can also register your agreement with Services Australia.

Child Support Cost

How much does child support cost?

The child support amount of support payable varies from family to family and is dependent on a number of factors, including the income of each parent and the amount of time the child is in each parent’s care.

The child support cost assumes the obligation of each parent to support their child financially and is, in principle, based on the percentage of time each parent cares for the child.

For example, if you and your ex-partner share joint custody of your children 50/50, expenses are more likely equal to shared parental responsibility. If one of you only cares for the children on weekends, you may be required to pay more child support.

Other factors come into play, such as school fees, medical bills or other expenses, which can vary greatly between families. To estimate the specific amount, consider using a child support calculator to get a clearer idea of the financial responsibilities involved.

How is child support cost calculated in Australia?

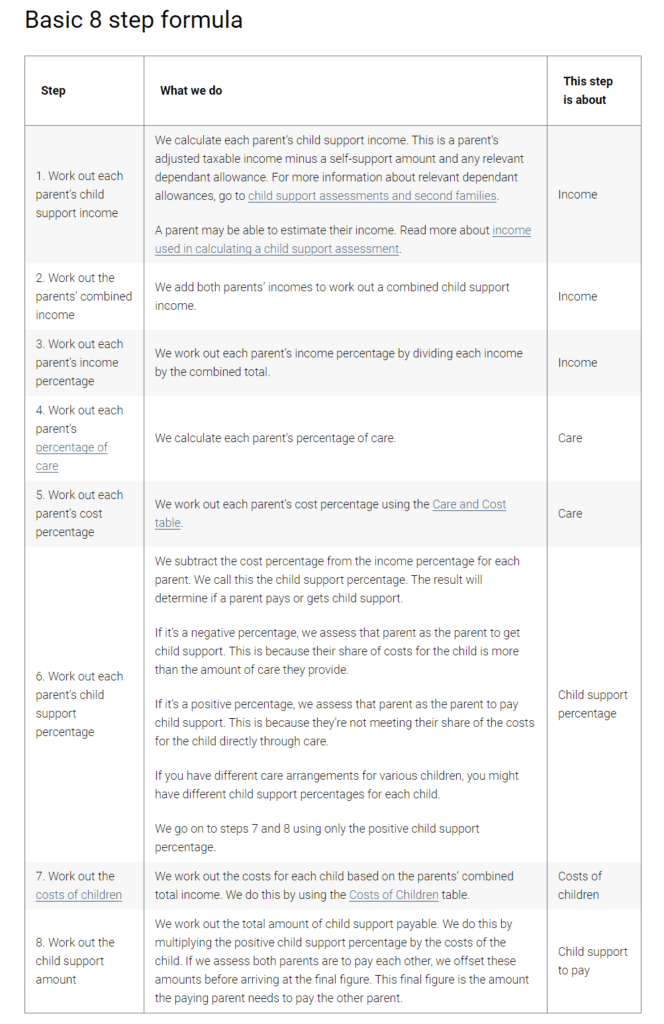

When managed by Services Australia, an administrative assessment of your situation is carried out to determine which parent should pay child support and how much. This child support assessment is done using a basic 8-step formula that takes into account:

The income available to each parent minus the cost required to ‘self-support’

The number of dependent children a parent needs to support and how old they each are

The amount of time the child spends with each parent

The percentage of the child’s costs each parent covers

The average cost of raising a child in Australia

Costs specific to this child

This child support formula determines an amount suitable for each child, payable by one parent, usually to the other.

How is child support paid?

Usually, parents make their own arrangements for how and when child support payments are made. If this is the case, keeping a record of payments for future reference is important.

If you and your ex-partner cannot reach an agreement, or if the parent responsible for paying support refuses, Services Australia can collect payment and redistribute it to the other parent.

Services Australia can also mandate that their employer deducts the amount from their wages to make the payment.

If you are entitled to be paid child support from your ex-partner but they’re refusing to pay, our experienced family lawyers can assist you in taking action to obtain payment.

To estimate the percentage of care used to calculate child support payments, kindly check this care estimator.

What is the maximum child support payable in Australia?

There is a cap on the maximum child support payable when the application is made through Services Australia.

This is calculated using the combined income of each parent, up to 2.5 times the annual equivalent of the Male Average Total Weekly Earnings, and the cost of children table, both of which can be found on the Australian Government’s website.

If you and your ex-partner choose to make an agreement privately, this amount may change.

Other Common Questions About Child Support

What if I am unhappy with the outcome of the administrative assessment?

In some cases, you may feel the child support assessments made by Services Australia are unfair to one parent. You may feel you are being asked to pay too much, or the payments your ex-partner is asked to provide are too little and you won’t be able to support your child financially.

In some cases, the assessment may become unfair if one of you loses your job, one of you has greatly minimised your taxable income for the purpose of the assessment, or if there are significant costs such as private school fees or medical fees for an unwell child.

If this happens, you can apply for your assessment to be reevaluated by Services Australia via an internal review process or apply to the Social Security Appeal Tribunal for a review. In some circumstances, you may be able to apply to the Court.

Suppose you and your ex-partner made a private child support agreement. In that case, our experienced family lawyers can also renegotiate to come to a new arrangement that better suits you and your ex-partner.

At what age does child support stop?

Child Support typically ends when the child turns 18. If the child is in their final year of high school when they turn 18, child support payments must continue until the end of that school year.

There are some cases in which child support payments continue after the child turns 18, which is called Child Maintenance. Child maintenance is payable if the child is studying secondary or tertiary education. This includes a university degree or an apprenticeship. Mainenance may also be payable if the child has a physical or mental disability, or if the child is seriously ill.

Child support payments don’t usually roll over into maintenance; an application must be made before the child turns 18 and can be made by either the parent or the child themselves. The amount of child maintenance payable depends on several factors, including:

The necessary expenses of the child.

The capacity the parent has to pay for these expenses.

The amount the parent requires to support themselves and any other dependents they have.

If a child under 18 gets married or enters into a de facto relationship, they are also no longer eligible for child support.

Which children are eligible for child support?

Child support is available to all children living in Australia whose parents are not together.

In order to be eligible for child support, a child must:

Be under 18 years of age, or 18 and in their final year of high school.

Not be married or in a de facto relationship.

Reside in Australia or a foreign jurisdiction with which Australia has a child support agreement.

Does a new partner affect child support?

The only people responsible for financially supporting a child are the child’s parents, and the amount of child support payable is calculated on the income of the child’s parents only. If one parent enters a new relationship or gets remarried, the amount they are required to pay does not change, unless the amount of time they care for the child changes.

If you or your ex-partner have a child with a new partner, you also need to alert Services Australia, as this may impact the amount of child support payable.

What if my former partner lives overseas?

If you’re ex-partner is living abroad, you may still be able to receive child support. Australia has agreements with many countries regarding the payment and enforcement of child support. These are called reciprocating countries. As the receiving parent, you must contact the child support authority in that country. A request will be sent to Services Australia to collect the payments for you.

Unfortunately, if your ex-partner doesn’t live in a reciprocating country, there’s little recourse. Some countries, such as the United States, England and New Zealand, will accept child support assessments made by Services Australia. In other countries, they require assessments to come from their own agency.

Conclusion

Child support in Australia is a legal obligation for parents to provide financial support for their children until they reach the age of 18. This is regardless of the custody arrangement. This support covers necessary expenses such as food, housing, education, and medical care. It ensures that children can maintain a reasonable standard of living after separation or divorce.

Parents can agree on child support through a binding agreement or have it assessed by Services Australia. Services Australia calculates payments based on various factors such as income and time spent with the child.

While riskier, parents can also organise child support informally. This can work if the co-parents are on good terms.

Do you need help with your child support obligations? Andrews Family Lawyers can provide personalised guidance and support to make the process easier for you. Contact us todaty for a free consultation.

If you need assistance with family law matters, Andrews Family Lawyers can help.